2009: Economic Outlook or LOOK OUT?

By Excerpts taken from TD Economics Special Report

Features New Technology Production2009 should be calmer, says TD report

It was only this past spring that world crop prices were soaring

because of concerns about global food shortages, there was growing

excitement about the use of food as a source of fuel and a surge in

speculative financial investment in commodity futures markets.

After the excitement of 2008, 2009 should be calmer, says TD report

|

|

| DAMPENED EXPECTATIONS The risk to agriculture prices continues to be tilted to the downside as financial markets remain unsettled and worries about the economy stay in the forefront. Advertisement

|

It was only this past spring that world crop prices were soaring because of concerns about global food shortages, there was growing excitement about the use of food as a source of fuel and a surge in speculative financial investment in commodity futures markets.

Now, food supply fears have eased considerably and growing worries about the global financial and economic landscape have dampened expectations for both world food consumption and investment in commodities, Derek Burleton told poultry producers at the Poultry Industry Council’s innovation conference in November.

After this roller-coaster ride, farmers must be wondering if more thrills and chills lie ahead in 2009.

“In the very short term, the risk to agriculture prices continues to be tilted to the downside as financial markets remain unsettled and worries about the economy stay in the forefront,” Burleton, director of economic analysis for the TD Financial Group said in a special report.

However, by mid-2009 he said prices should regain their footing.

A year ago TD issued a report that said while there would be short-term swings in prices agriculture’s long term looked bright.

“Notwithstanding the flurry of events over the past year, we stand by that assessment,” he said.

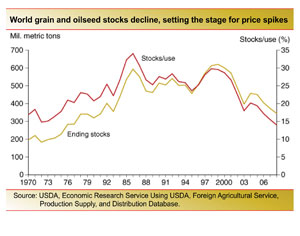

To some extent, the shift in global crop prices reflected movements in supply-demand fundamentals. After two straight annual declines in output and rising demand from emerging markets, the world entered 2008 facing critically low grain and oilseed stocks.

“If that wasn’t enough, ambitious government mandates for grain-based ethanol and biodiesel production continued to drive a wedge between global supply of crops and their traditional uses in feeding both households and livestock.”

Then world crop production responded to prices. Seeded acreage rose, especially in wheat and with good weather world wheat output grew 12 per cent.

In almost one fell swoop, global inventories were restored. Other major crops also enjoyed strong yields. Barley output is expected to grow 12 per cent and canola yields are the highest on record.

On top of the improved yields, agricultural commodities were not immune to growing worries about the impact of a global economic slowdown on consumption.

But while changes in expectations about fundamentals have been a major factor at work in crop markets, fingers have also been pointed at speculators and the trend in the U.S. dollar as key culprits behind the massive moves in prices.

WHERE ARE PRICES HEADING?

In this environment, we see the risks to agriculture prices tilted to the downside, as global economic and financial headwinds continue, the report says. As has been the case of late, most vulnerable to further selling are crop prices, which despite the clearing off of much of the speculative froth built up in 2007-08, remain especially prone to further liquidation of commodity positions by hedge funds and other institutional investors. Livestock prices – notably hogs –have less scope for declines since they are already at low levels.

Still, there are several reasons to suggest that any further weakening in crop prices from current levels will likely represent an “overshoot,” with prices undergoing a firming trend throughout the remainder of 2009 and into 2010.

For one, most crop markets are heading into this period of global downturn enjoying relatively well-balanced supply-demand conditions. Even then, demand for food tends to be less sensitive to deteriorating global income gains than other commodity areas. A bigger threat is on supply rather than demand, as ongoing credit problems globally could dampen sales of machinery, fertilizer and other inputs, thus impeding next year’s output.

HIGHER PRICE PLAEAU FOR CROPS TO REMAIN INTACT

Above all, we continue to see longer-term support for agricultural prices still at play. For several decades, crop prices globally had been falling in real inflation-adjusted terms as the contribution of rising productivity on global supply outstripped the impact of gains in demand.

However, even discounting the major up and down in prices in 2007-08, a pickup in global consumption growth vis-à-vis productivity has reversed the long-term decline in real crop prices.

TD Economics forecasts the economies of China and India to expand by 8.5-9 per cent and 6-6.5 per cent, respectively, in the 2009-10 period. This growth will continue to benefit both crops and livestock sectors.

Ethanol and biodiesel production will also grow and continue to underpin crop demand in the United States, Canada and elsewhere next year and over the longer haul.

From a Canadian perspective, the growing ethanol industry is a mixed blessing. While ethanol provides support to prices received by crop farmers, it raises the cost of livestock feed. Canada has traditionally grown more feed corn than demanded by livestock producers, with the surplus then shipped abroad. But with a growing amount of domestic production of corn used in the ethanol process, the country now records a corn trade deficit, which places prices on a higher import basis.

CANADIAN LIVESTOCK PRICES MAY NOT FOLLOW U.S. PRICES HIGHER IN 2009

With tightening global credit conditions and slowing economies around the world to lead to a slackening in red meat demand over the next few quarters, the hog and cattle markets are not expected to buck the continued downtrend in prices in the near term. However, we see some significant upside once the global economy begins to gain traction later in 2009 and into 2010. The outlook is for tightening supplies, reflecting in part the recent weakness in financial returns in the industry, the Canadian federal government’s Cull Breeding swine program and new U.S. legislation on country-of-origin labelling (COOL).

These factors are expected to have a major negative impact on Canadian exports to the United States.

OUTLOOK FOR CANADIAN FARM INCOMES IN 2009

The most recent data cover 2007, when realized net farm income rose to $1.7 billion. While this was double the 2006 level, it remained below the levels of $2-$3 billion recorded earlier in the decade.

For 2008, the picture is decidedly mixed. So far, only figures on farm cash receipts for the first and second quarters of the year have been released. And by that count, Canada’s farm sector is poised to turn in a stronger showing this year. During the year’s first half, total receipts shot up by 11 per cent year over year, as a 31per cent surge in crop receipts more than offset a four per cent decline in livestock.

But crop prices have retreated significantly since mid year, but so has the Canadian dollar, partially shielding Canadian farmers.

|

Also driving revenues is crop production which was generally favourable. Total wheat production is expected to rise 36 per cent in 2008, with canola and barley up 14 per cent and two per cent. Meanwhile cattle and hog production lost ground this year. In the hog industry, Canadian inventories fell by about 11 per cent as of October. Cattle inventories, which are reported semi-annually were down four per cent.

The greatest uncertainty surrounds input prices and how much profits were reduced by rising costs.

Forecasting whether the cost or revenue side will win out in 2008 is a tough call, TD says in the report.

In TD’s view, total net realized farm income will come in moderately higher than last year – in the $1.5-$2 billion ballpark, Burleton said.

A look ahead to the net income picture for 2009 also contains significant cross-currents, according to the report. TD expects:

- Canadian dollar to remain soft – next year, the loonie will continue to trade in the range of 80-90 U.S. cents, lower than its recently over-valued levels of 95-100 U.S. cents. While unambiguously positive for Canadian farmers from an output-price perspective, a weak currency raises the cost of U.S.-made inputs, such as farm machinery.

- Energy prices falling out of the stratosphere – crude oil prices are now trading at less than half of their recent peak of US$147 per barrel. While the price of crude should be supported by a pickup in global economy later next year, we see prices averaging a more manageable US$65-75 in 2009.

- Fertilizer prices should come down – While prices of nitrogen and phosphate fertilizer are expected to continue easing in tandem with crop prices over the first half of 2009, potash prices are likely to remain extremely elevated due to labour strikes and weak world production levels. Overall, however, crop farmers should see some reprieve in this all-important cost area.

- Transportation costs slackening – the easing in global growth is expected to take pressure off international freight costs, as evidenced by the steep drop in the Baltic Dry shipping index in recent months. This trend is likely to remain intact in 2009.

- Cost of credit – the global credit crisis has put upward pressure on the cost of availability of credit worldwide. While Canada has not been hit to the same degree, the impacts have been observable in the higher pricing of debt faced by banks and other large players, including many in agricultural sector, in the commercial paper market. In light of this stress, dealer finance programs are under threat, further limiting credit availability. The strains on credit markets are expected to recede as 2009 progresses, supported by efforts by world central banks and governments to boost liquidity, backstop inter-bank lending and lower short-term interest rates.

Putting it all together, the mix of still relatively high crop prices, a weak currency, and a simmering down in most cost pressures bode well for a further improvement in total farm income in 2009.

That said, there remain several clouds on the horizon.

Even with a Canadian dollar at 80-90 U.S. cents, many Canadian meat processors are still uncompetitive. What’s more, COOL is not likely to be the only challenge on the trade front facing Canada’s farm sector.

There are concerns the U.S. government could turn increasingly protectionist, the TD report says.

| 2009 HIGHLIHTS |

|

Print this page