Recession clearly impacting food industry

By Kevin Grier Senior Market Analyst

Features Profiles ResearchersWEB EXCLUSIVE

Recession clearly impacting food industry

The old adage “everyone’s got to eat” would seem to imply that food sales are relatively resistant to tough financial times.

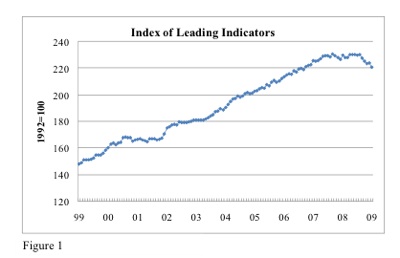

The old adage “everyone’s got to eat” would seem to imply that food sales are relatively resistant to tough financial times. However, changes in consumer behaviour over the past several months make it worthwhile to reflect on the overall economic situation facing the food industry. The Canadian Composite Index of Leading Indicators shows the performance of a number of items, including stock prices, durable goods sales, employment etc. As can be seen in figure 1, these leading indicators are showing a sharp decline in the latter part of 2008, and into January of 2009.

Figure 1:

|

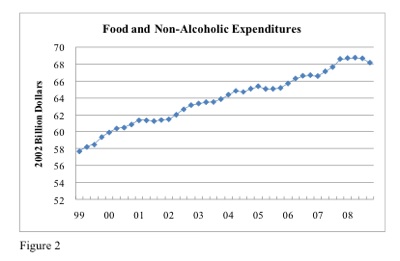

While this message might not be surprising, the fact is that the recession is having a clear impact on the food industry. Figure 2 shows StatsCan data on Personal expenditure on goods and services in constant 2002 dollars, seasonally adjusted at annual rates. More particularly it shows food and non-alcoholic beverages expenditures, as part of the personal expenditures.

Figure 2:

|

At no time in the last ten years, other than in the last quarter of 2008, did expenditures on food actually decline. During the dot-com meltdown, which coincided with the 9/11 attacks, expenditures slowed but did not decline. In fact, since 1982 there have only been three quarters, other than the fourth quarter of 2008, in which year-over-year food expenditures declined. Past performance showed that, with the exception of 1982, even in recession, food expenditures did not decline. As such, the decline in the fourth quarter of 2008 is definitely noteworthy.

The trade press has noted a number of ways in which consumers and retailers are responding to the recession:

- Increased purchases of private label products

- Trading down in terms of quality or type of product (hamburger versus prime rib)

- Fewer home meal replacement purchases

- More expenditure on basics or commodity lines

- Less spending on organics or other niche lines

- Reduced expenditures at restaurants or more spending at quick serve (again trading down)

- Increased expenditures at discount channels

- Visiting more stores to get the lowest price

- Reduced brand or product offerings

Retailers now report that consumers are showing increased price sensitivity and greater caution on total expenditures. This has major implications for companies focused on higher-end niches or value-added products. At the very least, it suggests that these companies need to reposition their value proposition relative to the competition. It will also mean redefining who their competitors are and what they are offering.

A version of this report appeared in the March 2009 issue of Grocery Trade Review, a George Morris Centre publication. If you are interested in a free two month subscription to Grocery Trade Review, e-mail Kevin Grier at kevin@georgemorris.org

Print this page