The Future Economy

By Peter Hunton

Features Business & Policy Emerging Trends Global Poultry Production Poultry ResearchHow it will affect poultry production, exports and marketing

Poultry meat will likely predominate in the new meat and protein markets because of price and other factors such as widespread production, lack of religious and cultural prejudices, accessibility and convenience.

Poultry meat will likely predominate in the new meat and protein markets because of price and other factors such as widespread production, lack of religious and cultural prejudices, accessibility and convenience. Two important plenary presentations by consultants at the XXIV World’s Poultry Congress last year gave important insights into the development of poultry production, exports and marketing in the next decades: Gordon Butland and Osler Desouzart from Thailand and Brazil, respectively.

Desouzart began his presentation by pointing out that, to the present day at least, the pessimistic predictions of the 19th-century scholar Malthus, have not been borne out. Malthus suggested that the expected food requirement of exponential increases in the human population could not be met by general geometric increases in food production.

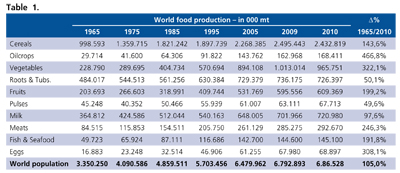

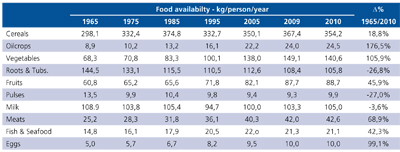

Desouzart showed data based on FAO figures demonstrating that in the period from 1965-2010, increasing world food production consistently outstripped population growth. While the human population doubled, production of cereals grew by 143 per cent, oilseeds by 467 per cent, meats (including poultry) by 246 per cent and eggs by 308 per cent. The only food categories that did not grow faster than the human population were roots and tubers, and pulses.

Future increases in food demand are expected to arise primarily in the developing world, as more and more people rise economically to the point where they have discretionary income to spend on food. It was stated that, “until the human reaches an income of $7.00/day, all income increase is used to enhance the diet.” These expenditures are likely to be directed preferentially to increasing meat consumption, in which poultry will play a major role.

While consumers in developed countries are demanding variations in food sources (organic, GMO-free, etc.) the vast majority of “new” consumers entering the market for meat and protein will be much less selective, according to Desouzart.

And of course, in order to meet this new demand, up-to-date technology will be required, which will include biotechnology and other high-tech methods of growth and processing. The niche markets in the developed world will continue to expand but they will not become the standard worldwide. The majority of undernourished people today, and the potential new consumers of tomorrow, reside in Asia, the Pacific and sub-Saharan Africa. Desouzart states that “science and technology are indispensable for the new green silent revolution that will permit the world to cope with food demand to 2050.” They (science and technology), “should be guided by ethos and not limited by activism normally coming from the full-pockets and full-bellies areas of the world.”

Why is poultry meat likely to predominate in the new meat and protein markets? It is not just price that makes poultry meat the major contributor, but also other factors such as widespread production in almost all countries, lack of religious and cultural prejudices, accessibility and convenience, and availability of a multitude of different products to meet almost all possible demand. There is also the fact that of all the meat products, poultry is by far the most efficient both in terms of feed conversion and water requirement. Feed-efficiency data are well accepted; Desouzart quoted UN figures showing the litres of water required per kilogram of meat from beef to be almost 16,000 litres, and from pork, almost 6,000 litres. Poultry required only 2,800 litres.

With all these positive messages, one could be forgiven for believing that the industry has few, if any, problems. However, Gordon Butland brought the meeting down to earth in his review of current costs and prices. The best illustration of this is probably the graph drawn from the Chicago Board of Trade Index Mundi for corn, wheat and soybeans. Taking 1997 prices as 100, corn in July 2012 was slightly above 200 and soybean meal 220, and both are still rising. This results from a combination of a poor 2011 harvest, increased use of corn for ethanol production and continuing high demand for imported feed ingredients in China and elsewhere. While this affects all meat producers, poultry producers are massively involved, as few feed ingredient substitutes are readily available. The immediate effect has been reduced production, since in many cases chicken prices cannot be increased to cover the extra cost of production. Markets in the United States and Europe are still suffering from the global economic crisis of 2009 and consumers have cut back on staple food items.

Another of Butland’s graphs showed sales prices for chicken trending downwards, while feed cost increases skyrocket. He illustrated the size of the “problem” as follows:

- fifty billion chickens/year globally

- about 100 million metric tonnes live product/year

- about 500,000 metric tonnes feed/day

- of which about 350,000 metric tonnes are corn and soy

- every US$100/metric tonne feed cost is US$35 million extra cost/day for the poultry industry

- US$13 billion/year = about US$200/metric tonne on finished products (20 cents/kilogram)

Adaptation to these new realities will test the viability of many companies. However, Butland also pointed out that he still sees tremendous variation in efficiency between top and bottom quartile companies, and thus there will be those that survive and prosper, and those that fail. It is also a situation that favours the large, efficient companies. Anyone involved in exporting chicken products needs to have as close a relationship with the end consumer as possible and only the largest companies can afford to be represented in most or all of their client countries.

World food production from 1965 to 2010, provided by the Food and Agriculture Organization of the United Nations (FAO).

So how will this adaptation to the new prices and cost structure be accomplished?

Osler Desouzart says that the use of well-proven biotechnology will be the key. He stated: “Science and technology should have their limits determined by ethics and the pursuit of mankind’s well-being. Let science do its work and we shall feed the 9.3 billion inhabitants of the planet by 2050.”

Questioned as to the response to the activists who often criticize the unbridled application of science, Desouzart basically advised industry to ignore them, if indeed we are to feed a hungry world. “Activism sometimes assumes the airs of a re-enactment of the Spanish Inquisition and some attitudes approach neo-Luddism,” he said.

While not everyone agreed with him, such attitudes need to be expressed, because many activist positions are based on incomplete knowledge. The food production industry also generally has a poor record of keeping consumers informed of its practices. One relatively new approach, recently seen in “The Furrow” (a John Deere publication) is that of the U.S.

Farmers and Ranchers Alliance, whose focus is on “improving the conversation between consumers and farmers and ranchers.”

Only by using these types of organizations (the Canadian Farm Animal Councils are another good example) can poultry producers expect to hold consumers’ trust while using legitimate, up-to-date technology.

Print this page