2010 Agricultural Outlook

Jim Knisley

Features Manure Management ProductionA recent TD Bank Financial Group report outlines 2009 and forecasts bright long-term prospects

Canada’s supply-managed industries were bastions of relative calm

during 2007 and 2008, when huge price swings engulfed agricultural

markets and stayed on course during the deep recession of 2009.

Canada’s supply-managed industries were bastions of relative calm during 2007 and 2008, when huge price swings engulfed agricultural markets and stayed on course during the deep recession of 2009.

|

|

| Emerging markets are expected to underpin demand for agricultural products as incomes and populations continue to grow rapidly, increasing the desire for high quality foods – particularly meat, according to TD. |

Derek Burleton, director of economic analysis for the TD Bank Financial Group, told those gathered at the Poultry Industry Council’s Innovations Conference in Niagara Falls in November that the bank’s portfolio of loans to poultry producers is in excellent shape, reflecting the health of the industry.

He also said that the first half of 2009 was “a period of relative calm for the [Canadian] agriculture sector.”

“Even during the worst of the largest global recession in half a century, agricultural prices, for the most part, managed to hold up quite well during the first half of this year given the fact that people still needed to eat,” TD said in an agriculture outlook report.

But the “the fortunes in the agricultural sector have since taken a turn for the worse,” the report said.

Prices have started to sag and the downward pressure is likely to continue in the near term because of excess supply of major commodities.

However, a drop in input prices, most notably fertilizer and fuel, will help keep total farm income relatively stable.

|

“Longer term, however, the outlook for the agricultural sector in Canada remains quite bright. Demand for crops from the ethanol and biofuels industries, although taking a backseat in the media recently, is expected to remain strong. And with government mandates still in place, this trend is likely to continue to support demand and prices for crops.”

“Emerging markets are also expected to underpin demand for agricultural products as incomes and populations continue to grow rapidly, increasing the desire for high quality foods – particularly meat,” the report said.

For the battered cattle and hog sectors “the emerging markets provide enormous opportunities for Canadian farmers to diversify away from the United States.”

Key elements in accessing those markets will be improving quality and food traceability.

|

Crop Outlook

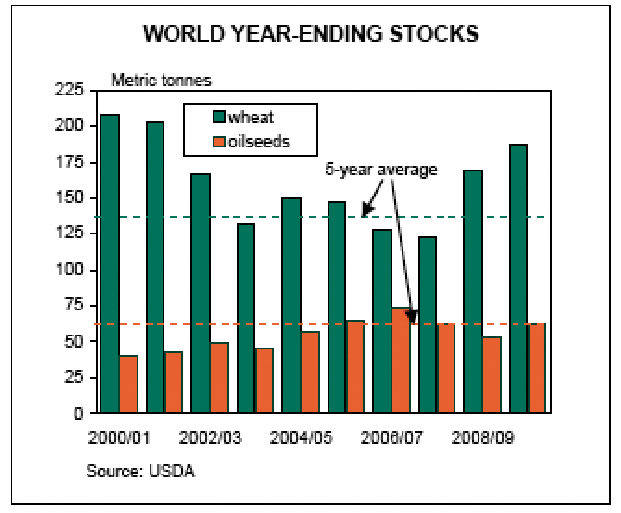

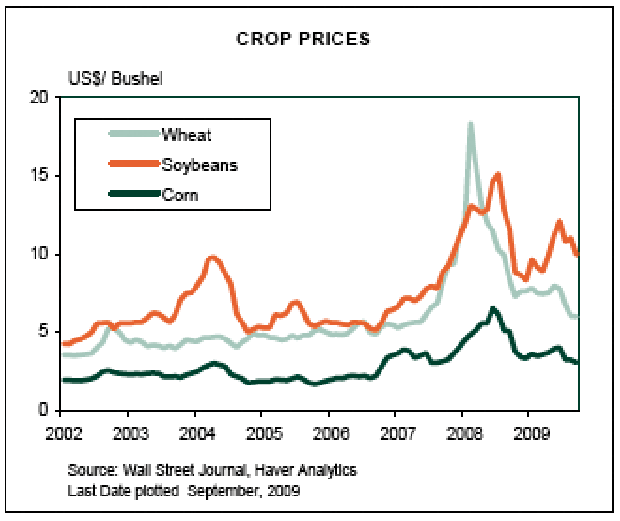

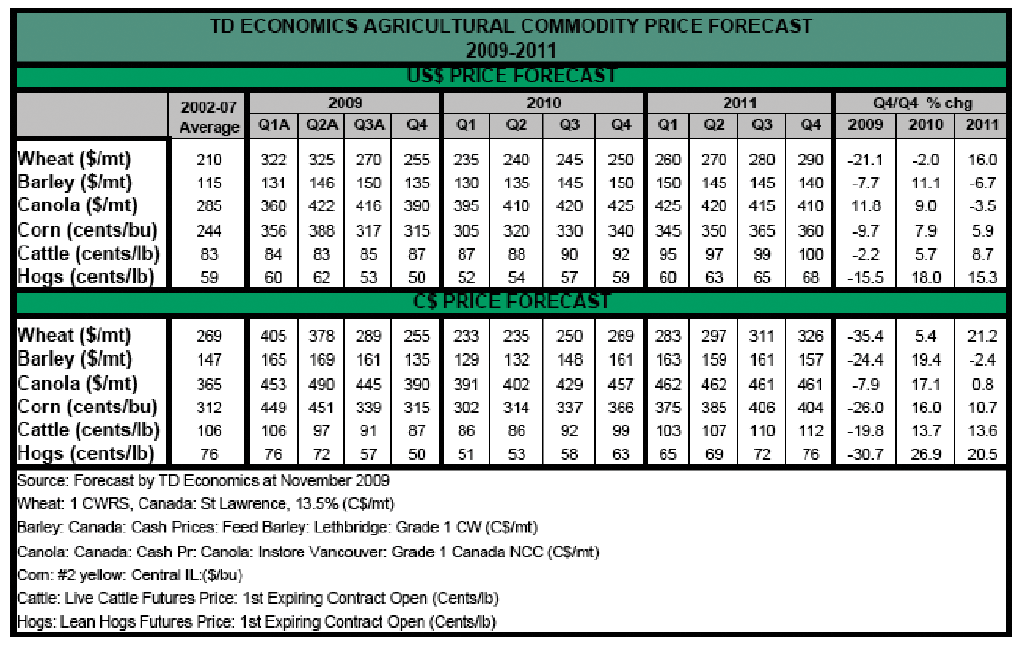

The wheat market appears to be suffering from the largest global supply glut, as shown by the sharp drop in prices in recent months. After ending the 2008-09 crop year at a six-year high, carryover stocks are expected to be about 12 per cent higher at the end of the 2009-10 crop year. Other global crop markets, including corn, soybean and barley, are following along the same path, as 2009-10 output is likely to hit new highs, easily meeting, if not exceeding, demand. As such, year-ending stocks are expected to reach record or near-record levels for most crops this year, according to TD.

Livestock

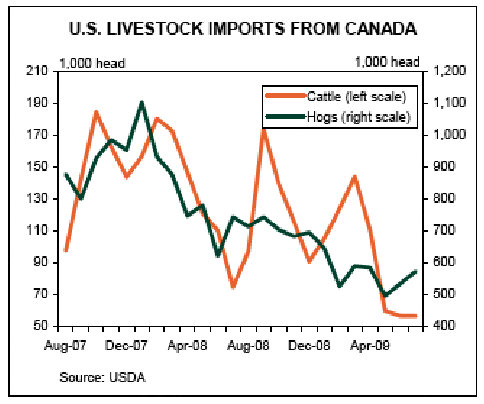

In addition to the slump in demand brought on by the recession, Canadian cattle and hog producers have faced a slew of other challenges. The final rule of the Country of Origin Labelling (COOL) legislation in the United States came into effect in March. Meat packers in the United States were also asked to take on further voluntary measures when dealing with foreign meat. As a result, Canadian exports to the United States have dropped this year, with both cattle and hog exports down by nearly 25 per cent year over year in July. Unable to come to an agreement with officials in the U.S., the Canadian government requested last month a WTO panel to settle the dispute, stating that COOL unfairly discriminates against Canadian producers. WTO panels typically take about nine months to release the final report, so this legislation will continue to plague the livestock market in Canada through 2010.

|

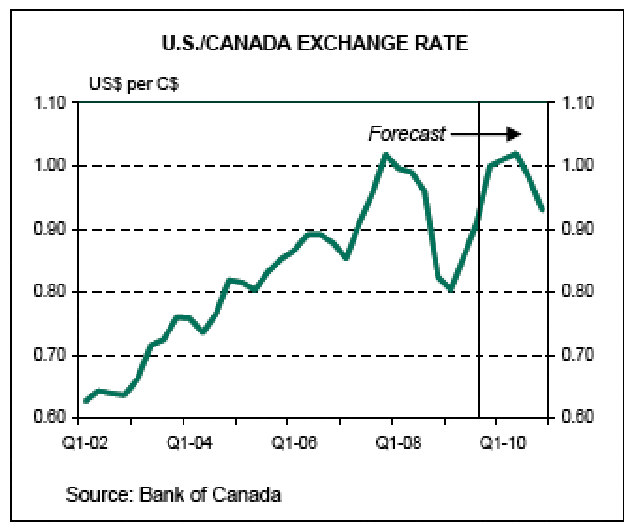

The Dollar

Thanks to stronger fundamentals in the Canadian economy, TD expects U.S.

dollar weakness to persist through the first half of 2010. The loonie will likely reaching a peak of 102 U.S. cents in the second quarter, before heading back towards the mid-90s later next year.

Farm Debt

Despite a surge in net farm income in 2008, farm debt outstanding was 14 per cent above the 2003-2007 average. This uptrend likely continued into 2009 and will persist in 2010 as well. However, the cost of borrowing should remain low, as the Bank of Canada will likely keep rates down until the fourth quarter of 2010.

Energy and Fertilizer

Energy prices are likely to edge up slightly compared to 2009, though the supply glut overshadowing the market will keep prices in check. Despite an uptick in demand as the economy recovers, TD expects crude oil prices to hover in the US$65-75 per barrel range in 2010.

Fertilizer prices are also likely to edge up next year. Although some farmers may decide to go another year with reduced fertilizer usage, others will begin to replenish the soil so that yields aren’t compromised, thereby increasing demand. But while fertilizer prices will likely return to levels above the averages seen in the years prior to the massive surge, the forecast doesn’t expect them to rise anywhere close to the highs seen in 2008, TD said.

|

Long-Term Outlook

All in all “the longer-term prospects for the Canadian agricultural sector remain quite promising, as the uptrend in prices that began at the start of the decade will likely remain intact,” TD’s special report said.

The Other Economy

Other sectors of the Canadian economy will not be as fortunate as agriculture. A “new normal” is emerging for post-recession Canada that will include slower growth. This will affect both household and government income, TD says.

“It is critical to recognize that things will not simply return to how they were,” Burleton said.

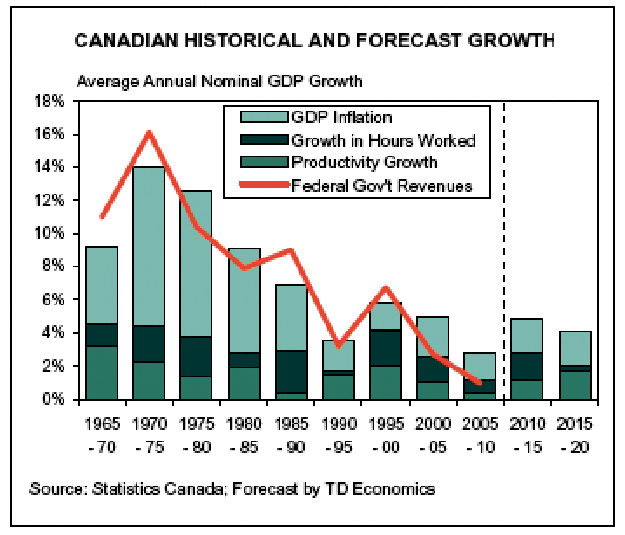

Slower Growth

The TD outlook for the Canadian economy as a whole projects reduced average potential economic growth.

|

“We forecast a slump in Canada’s average potential growth to 1.6 per cent over 2009-2012 (a near halving of its historical pace) with a return to only an average of 2.1 per cent across 2013-2019,” TD economists said in the report that looks at Canada’s potential growth during the economic recovery and beyond.

“This presents a ‘new normal’ for the budgets of households and governments, with annual nominal income growth looking to average around four per cent.”

Potential growth is generally considered to be the amount that can be produced when capital and labour are fully employed. This serves as a “speed limit” for an economy’s long-term growth. Real growth, as measured by gross domestic product, can outpace potential growth in post-recessionary periods as excess capacity is absorbed. But real growth converges with potential growth over the longer term.

Restructuring

“In the near term, the restructuring challenges for major sectors, resulting in displaced workers and obsolete production capacity, will slow potential growth substantially,” the TD team wrote.

|

|

“Unemployment will result in the atrophying of certain skills and, with the permanent closure of plants, certain work experience that is process specific will become obsolete. Unemployed workers’ success in retraining is crucial to boosting the longer-term growth in labour quality, but successful training will not happen overnight.”

Aging Population

“Our forecast implies that per capita input will grow at a slowing pace, implying proportionately fewer resources per person with which to support higher living standards. While labour force growth will receive a temporary boost from postponed retirement, this cannot sustain,” the report said.

“Canada’s population will grow more rapidly than the labour force will grow – likely beginning in 2013 or 2014. Although productivity growth will improve during 2012-to-2019, we do not anticipate sufficient productivity growth to offset the demographic deadweight on growth per-capita output, which results from a pace of labour force growth that is less than the population growth rate.”

Innovation

As the labour force ages, Canada’s future growth will rely increasingly on productivity. The economists said they expect to see a pickup in productivity over the mid-to-late part of the next decade. But the productivity gains will be well below those achieved in the boom of the late 1990s.

“We do not see a compelling case for a major productivity resurgence, given Canada’s poor record on innovation. Slumping expenditures on research and development and low investment in high-tech capital by Canadian businesses appear the prime culprits for Canada’s lack of innovation and overall slowing of productivity growth.”

Profits and Income

Growth in corporate profits for Canada-focused firms will be restrained by the growth rate of the economy, and household income cannot outpace economy-wide growth over the long haul, the TD report said.

Meanwhile, investors will increasingly look abroad for better returns, but high-growth emerging markets will be volatile and more risky.

Households cannot continue to borrow at rates exceeding income growth and prospective asset appreciation. Continued debt growth and stagnating disposable income could result in “heightened household vulnerability and credit risk,” TD said.

The Bright Side

Canada has attributes that are expected to prevent a bigger slowdown in potential growth over the next few years.

For one, its banks are in good shape and should be safe from “the still-festering wounds of the financial crisis.”

In addition Canada’s commodity-heavy economy should benefit from a restrained recovery in commodity prices that can affect currency value and investment allocation.

“Commodity prices are expected to recover over the next few years, but remain well below their recent peaks set in 2007-2008. As such, we expect that some of the productivity dampening distortions that accompanied the resource boom will ease over the next few years,” TD said.

The economy will also reap the benefits of infrastructure projects announced during the recession. Work on many of these projects will hit stride in 2010 and continue into 2011.

TD also says business investment should be encouraged by measures to lower the marginal effective taxation of business through lower income tax rates and federal-provincial sales-tax harmonization in Ontario and British Columbia, as well as temporary measures to accelerate capital cost write-offs.

The strong Canadian dollar should also encourage spending on new equipment.

| A brief history of Canadian economic growth since 1960

The 1960s saw average annual output growth of upwards of five per cent. Productivity growth was rapid due to extremely high-quality and large-scale capital investment, reflecting the buildup of Canada’s heavy industry. The roll-out of needed infrastructure had high public returns and boosted productivity. The decade witnessed a swell in national and provincial road networks, in environmental infrastructure (sewage and water) and in cultural and recreational facilities. Productivity also surged for strong improvements to labour quality, following from the baby boomers’ completion of college and university education. Technological progress was generally strong, with real business-sector spending on R&D advancing by more than eight per cent annually between 1963 and 1970. The 1970s and 1980s saw more moderate human capital growth and growth of the capital stock slowed during the 1980s. Capital growth had remained strong during the 1970s. However, during the 1980s, returns on investment were diminished by high inflation and consequent interest rate hikes, as well as the tax burden of rising deficits. Infrastructure roll-out remained strong in the 1970s but slowed further in the 1980s. The expansion of infrastructure expenditures during the 1960s and 1970s created public works for which demand “filled in” over time. With the major networks established, slowing infrastructural expenditures during the 1980s reflect diminishing returns on new infrastructure investments. During the 1990s – particularly the latter part of the decade – growth was boosted by a resurgence in productivity. Technology owed its strong progress to innovation and adoption of general-purpose information and communication technologies (ICT). Capital expenditure slowed further from the 1980s, but growth in the quality of capital improved, consistent with higher ICT investment. The post-2001 growth slowdown reflects a slump in productivity growth to an annual average of just over one per cent. Outright technological regress was a major drag. The retreat of the state of technology reflected diminished innovation and was contemporaneous with steeply diminished expenditures by business on R&D. While the growth of the capital stock has accelerated, the growth in the quality of capital has slowed from the 1990s, at least partially as a result of the slumping share of ICT capital. The expansion of infrastructure also slowed, with renewed infrastructure spending largely “patching holes” rather than creating new public works. Human capital growth has also slowed as a consequence of a booming economy and diminished incentive for educational attainment. However, the growth in labour hours accelerated from the 1990s, with higher participation induced by strong labour markets, as well as demographic factors. (Source: TD Bank) |

Print this page