Food Inflation

By Treena Hein

Features New Technology Production Business/Policy CanadaHow food inflation rates will affect the poultry industry this year

Here’s some good news in a downtrodden economy: inflation for grocery items in Canada will stay stable or rise by only one per cent in 2014, according to Kevin Grier and Janalee Sweetland at the George Morris Centre in Guelph, Ont. In addition, chicken sales are likely to increase.

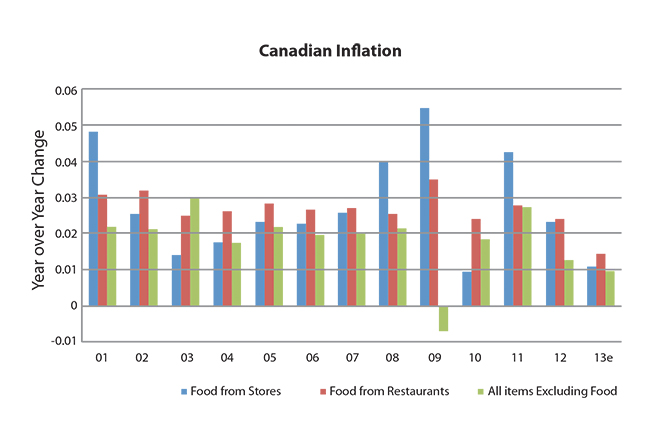

In terms of recent inflation trends for grocery items, Grier and his colleague, Sweetland, say the Statistics Canada Consumer Price Index shows the 2013 inflation rate was one per cent compared to the previous ten-year average of three per cent. “The inflation of store-purchased food over the past four years has sharply decreased,” Grier says. “Price increases for restaurant food has also been on a downward trend over that period of time.” The cost increases for all other (non-food) items has averaged two per cent over the past ten years, with a recessionary price decrease in 2009.

Food prices, Grier explains, are strongly correlated with the cost of animal and vegetable products (eggs, cranberries, flour, etc.) as well as other inputs such as raw materials, electricity and transportation fuel. “Food manufacturer raw material costs have been in decline or stable over the past two years,” he notes. “As such, it is reasonable to assert that food prices will not be under any upward pressure at all during 2014.”

Currency exchange rates also affect food prices, but again, stability is indicated. Currency exchange rates over the past ten years have been increasing, but recently, the reverse has been true. Increasing exchange rates can make imported goods cheaper, says Grier, causing prices for domestic goods to lower so that they remain competitive, and there is long-term trending pressure from increasing currency rates that will result in lower Canadian food pricing.

|

| The inflation of store-purchased food over the past four years has sharply decreased, according to the George Morriss Centre. Photo courtesy George Morris Centre |

According to Grier, another reason that food prices will generally remain stable is Canada’s economy. “It’s expected to continue to strengthen only slightly over the next two years, with the Bank of Canada projecting 2.3 per cent growth in GDP in 2014,” Sweetland points out. “Other projections for the Canadian economy are less optimistic, and relatively slow economic growth does not typically coincide with an environment in which prices are able to be greatly increased.”

Consumer confidence — another factor affecting food prices — rose somewhat in 2013, but it remains well below pre-recession levels. “Cautious spending habits don’t support an environment that is conducive to aggressive price increases,” explains Sweetland. “It’s a well-established fact that during slow economic times, significant numbers of consumers seek to lower their grocery bills by substituting for cheaper options.” She notes that as a recession progresses, this becomes less intense, but that it has the effect of creating habits amongst consumers to substitute lower-priced items when prices begin to creep upwards. Slower growth in per capita incomes and an increased focus on building household savings has also helped to keep food inflation tepid over the past several years.

However, the most significant factor that will keep a lid on rising food prices this year is the increasing competitiveness among the various grocery outlets operating in Canada. The opening of new Target stores and further aggressive expansion into the grocery business by Walmart and Costco are playing an important role in this battle for the consumer dollar. Grier believes competition at the grocery store will continue to be intense, and will be the most persuasive of the influences over food prices in 2014.

“Research done by CIBC Institutional Equity notes that Walmart is going to try to increase its share of the grocery market through changing its store conditions, running a stronger flyer, sharpening its assortments and improving its fresh departments in 2014,” Grier adds. “Asian grocers are also expanding, with CIBC identifying over 90 in the Greater Toronto Area, and probably 200 nationally. They are continually lowering their prices and improving distribution, thereby attracting more and more non-Asian customers.” He adds that in Canada, ethnic grocers probably sell as much food as Walmart does.

The one important exception to stable food prices, however, is meat. “Cattle and hog supplies are tight and meat prices will be under upward pressure,” Grier says. Chicken prices were exceptionally volatile in 2013 and strong demand this year will put prices on the upswing, but they won’t approach the price of beef. Grier thinks that during 2014, the chicken industry can “sit back and watch the beef industry lose share” at grocery and foodservice outlets. “Grocers are already scared away from beef for featuring [as a star product], and are even looking to turn more counter space over to chicken and pork,” he notes.

A good time, then, for aggressive marketing of poultry products and eggs? When asked if Chicken Farmers of Canada will be putting any special efforts into marketing this year related to high beef prices, the association did not specify. Egg Farmers of Canada chose not to comment.

Taking a look at the U.S.

A January 2014 Food Price Outlook report from the United States Department of Agriculture’s (USDA) Economic Research Service states that beef and veal prices in the U.S. will likely increase three to four per cent this year over 2013 levels. It also states “many retail beef prices are at or near record highs across the country, even after adjusting for inflation. Currently, [we] forecast that beef prices will rise more than most other prices in 2014.”

The report states that poultry prices in December 2013 were three per cent over December 2012 levels, and that U.S. poultry prices (including turkey) are expected to rise more than overall grocery prices in 2014 due to strong anticipated demand. Egg prices rose 5.8 percent in the past year. “However, egg production is forecast to expand in 2014, and inflation for this category is expected to be in line with the historic average.”

Readers can obtain the George Morris Centre report, Canadian Chicken Market Review for a free two-month trial by emailing kevin@georgemorris.org

Print this page